Is The Window Closing?

|

|

With interest rates lower than they’ve been in over 40 years, it may be difficult to think of a “window of opportunity” closing. However, it isn’t difficult to understand that it may very probably cost more to live in a home in the near future due to rising interest rates and prices.

Zillow recently reported results from a nationwide study that home values are expected to appreciate by 4.5% through the end of the year. Coupled with Freddie Mac’s projection that rates are going up, the cost of housing for buyers by the end of the year will be higher than it is now.

While uncertainty of the future can stagnate some people, the fear of loss can be much more devastating when a person realizes that the amount they pay to live and enjoy a home could have been considerably lower had they acted when prices and mortgage rates were lower.

The following example considers a $250,000 purchase today with a FHA mortgage compared to what it might be at the end of the year with a higher price and interest rate as discussed earlier. The net effect is that it will cost $191.87 to live in the very same home based on the cost of waiting to buy.

To see what the cost might be for your price range, use this Cost of Waiting to Buy spreadsheet.

|

|

Interest Rates Are Not Getting Any Lower!

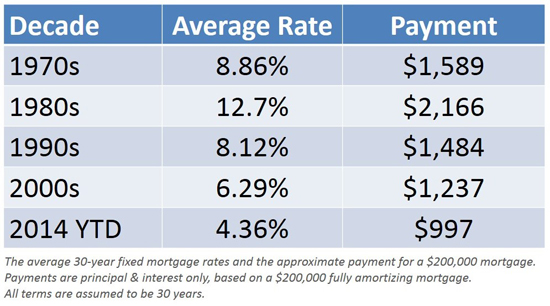

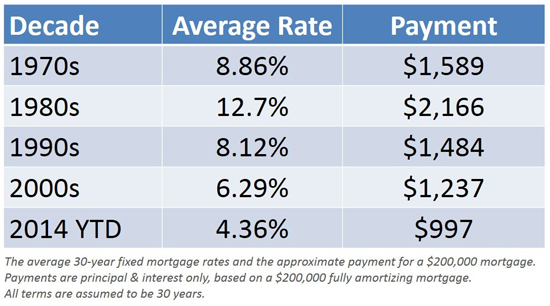

"One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

– Freddie Mac, March 24, 2014

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to theless than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their new blog, explained that current rates are still extremely low compared to historic averages:

"The all-time record low – since Freddie Mac began tracking mortgage rates in 1971 – was 3.31% in November 2012. Conversely, the all-time record high occurred in October of 1981, hitting 18.63%. That's more than four times higher than today's average 30-year fixed rate of 4.32% as of March 20…rates hovering around 4.5% may be high relative to last year, but something to celebrate compared to almost any year since 1971."

If you are thinking of buying a home, waiting for a dramatic decrease in mortgage rates might not make sense.

Home Inventory Levels Are Up!

Just as we predicted. All across the United States the home inventory levels are going up! The real estate market is looking good. If you are thinking about listing your house now would be a great time to do it.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link