Target Range

Today we are going to explore target range. This neighborhood is beautiful and close to town! Check it out here:

http://www.livemissoula.com/explore-missoula/target-range-neighborhood/

Is The Window Closing?

|

|

With interest rates lower than they’ve been in over 40 years, it may be difficult to think of a “window of opportunity” closing. However, it isn’t difficult to understand that it may very probably cost more to live in a home in the near future due to rising interest rates and prices.

Zillow recently reported results from a nationwide study that home values are expected to appreciate by 4.5% through the end of the year. Coupled with Freddie Mac’s projection that rates are going up, the cost of housing for buyers by the end of the year will be higher than it is now.

While uncertainty of the future can stagnate some people, the fear of loss can be much more devastating when a person realizes that the amount they pay to live and enjoy a home could have been considerably lower had they acted when prices and mortgage rates were lower.

The following example considers a $250,000 purchase today with a FHA mortgage compared to what it might be at the end of the year with a higher price and interest rate as discussed earlier. The net effect is that it will cost $191.87 to live in the very same home based on the cost of waiting to buy.

To see what the cost might be for your price range, use this Cost of Waiting to Buy spreadsheet.

|

|

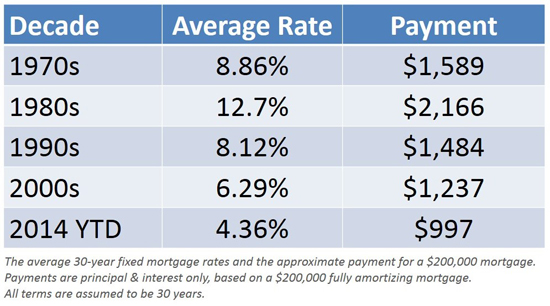

Interest Rates Are Not Getting Any Lower!

"One thing seems certain: we aren't likely to see average 30-year fixed mortgage rates return to the historic lows experienced in 2012."

– Freddie Mac, March 24, 2014

There are those that hope that 30-year mortgage interest rates will head back under 4%. Obviously, for any prospective home purchaser that would be great news. However, there is probably a greater chance that interest rates will return to the greater than 6% rate of the last decade before they would return to theless than 3.5% rate of 2012.

Freddie Mac, in one of four original posts on their new blog, explained that current rates are still extremely low compared to historic averages:

"The all-time record low – since Freddie Mac began tracking mortgage rates in 1971 – was 3.31% in November 2012. Conversely, the all-time record high occurred in October of 1981, hitting 18.63%. That's more than four times higher than today's average 30-year fixed rate of 4.32% as of March 20…rates hovering around 4.5% may be high relative to last year, but something to celebrate compared to almost any year since 1971."

If you are thinking of buying a home, waiting for a dramatic decrease in mortgage rates might not make sense.

Looking For The Largest Deduction?

|

|

IRS allows taxpayers the option to take the standard deduction or the itemized deduction. The astute taxpayer will compare to see which one will result in the greatest deduction and the election can be made each year.

The 2013 standard deduction for a married couple filing jointly is $12,200 and $6,100 for a single taxpayer. It doesn’t require any proof of actual expense and has no requirement for home ownership.

Items that can be included on Schedule A for itemized deductions include:

- Certain taxes paid for state and local income tax, general sales tax, real estate property taxes, personal property taxes or other taxes paid

- Qualified home mortgage interest, investment interest or possibly, mortgage insurance premiums

- Charitable contributions

- Casualty or theft losses

- Medical and dental expenses that exceed 7.5% of adjusted gross income if born before 1/2/49 or 10% if born after 1/2/49

- Job expenses and other miscellaneous deductions that exceed 2% of adjusted gross income

A non-homeowner taxpayer who has been taking the standard deduction needs to consider that it isn’t just the ability to deduct the mortgage interest and property taxes.

While the standard deduction might be the obvious choice for a non-homeowner, the combination of the mortgage interest and the property taxes plus other allowable deductions not recognized previously such as charitable contributions, now makes taking the itemized deductions significantly more advantageous.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link